Welcome to our online VAT calculator for the UK. Designed to accommodate recent VAT rate changes, our unique tool allows users to adjust the VAT rate and effortlessly calculate net or gross amounts. Whether for business or personal use, our calculator provides flexibility and ease of use.

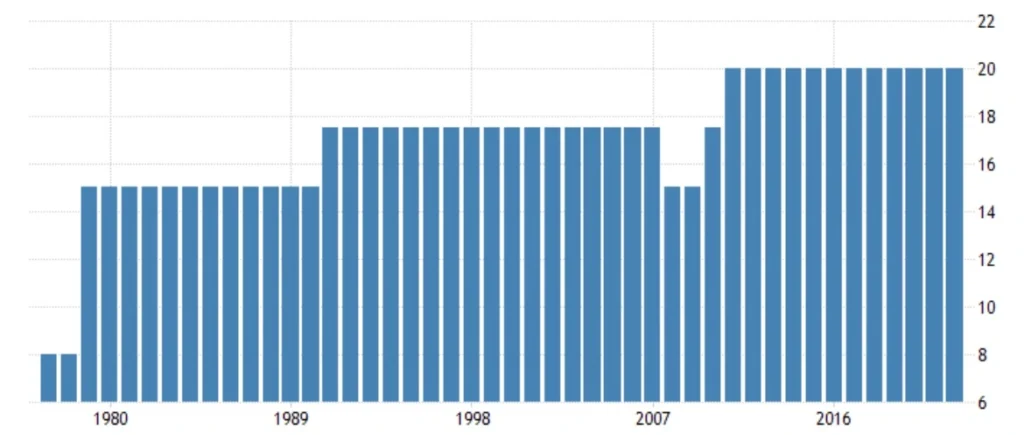

The current UK VAT rate is 20%, increased from 17.5% on January 4, 2011. Previously, it was temporarily reduced to 15% on December 1, 2008, and reverted to 17.5% on January 20, 2010. Take advantage of our reliable calculator for accurate VAT calculations.

Free Online UK VAT Calculator

- UK standart rate: 20%;

- UK reduced rates: 5% and 0%.

Amount:

VAT Rate (%):

Value Added Tax (VAT) in the United Kingdom

Value Added Tax (VAT) is a consumption tax levied on goods and services in the United Kingdom. It is an indirect tax that is ultimately borne by the end consumer. VAT is administered and collected by HM Revenue and Customs (HMRC) on behalf of the government.

How VAT Works

VAT is charged at each stage of the supply chain, from the manufacturer to the retailer, and is added to the selling price of goods or services. The standard VAT rate in the UK is currently 20%, although there are reduced rates and exemptions for certain goods and services.

The standard VAT rate is 20%

Calculating VAT

To calculate the VAT amount, you can multiply the net price of the goods or services by the VAT rate. For example, if the net price is £100 and the VAT rate is 20%, the VAT amount would be £20, resulting in a total price of £120. Similarly, you can calculate the net price by dividing the gross price by 1 plus the VAT rate. In the previous example, the net price would be £100 (£120 divided by 1.2).

VAT Registration

Businesses with an annual turnover above the VAT registration threshold are required to register for VAT. This threshold is currently £85,000 in the UK, but it is subject to change. Once registered, businesses can charge VAT on their supplies and claim back VAT paid on their purchases and expenses. Registered businesses must also submit regular VAT returns to HMRC, detailing their VAT transactions.

VAT Rates

Different goods and services in the UK are subject to different VAT rates. While the standard rate is 20%, there are reduced rates of 5% and 0% applicable to specific items such as certain types of food, children’s clothing, and books. Zero-rated supplies do not incur VAT, but they are still included in VAT returns. Exempt supplies, on the other hand, are not subject to VAT, and businesses making only exempt supplies cannot reclaim VAT on their expenses.

VAT Invoices and Records

Businesses must issue VAT invoices when supplying goods or services to other VAT-registered businesses. These invoices should include specific details such as the VAT registration number of both the supplier and the customer, the VAT rate applied, and the VAT amount. VAT records must be kept for a minimum of six years and should include all sales, purchases, and expenses related to VAT.

VAT in International Trade

When importing goods into the UK, VAT is generally payable at the point of importation. VAT-registered businesses can often reclaim this VAT on their VAT return. For exports, VAT is usually not applicable, as it is considered a zero-rated supply. However, specific rules and documentation requirements apply to international trade, and businesses should familiarize themselves with these regulations.

VAT Inspections and Penalties

HMRC conducts periodic VAT inspections to ensure compliance with VAT regulations. During an inspection, businesses are required to provide records and answer questions related to their VAT affairs. Non-compliance with VAT rules can result in penalties and fines, so it is important for businesses to maintain accurate records and meet their VAT obligations.

Conclusion

Value Added Tax is a significant aspect of the UK’s tax system, generating substantial revenue for the government. It is a complex tax, with various rates and rules that businesses must adhere to. Understanding VAT, calculating it correctly, and fulfilling VAT obligations are crucial for businesses operating in the UK. By complying with VAT regulations, businesses can avoid penalties and contribute to the overall functioning of the tax system.

Quick Answers

What is VAT?

VAT (Value Added Tax) is a consumption tax levied on goods and services in the United Kingdom, paid by the end consumer at each stage of the supply chain.

How to calculate UK VAT?

To calculate VAT in the United Kingdom, multiply the net price of goods or services by the applicable VAT rate (e.g., 20%) or divide the gross price by 1 plus the VAT rate.

Is there any product or service that is not taxed?

Yes, there are certain goods and services in the United Kingdom that are exempt from VAT or subject to reduced rates, such as certain types of food, children’s clothing, and books.